There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

The Best Financial Modelling Course At Super Affordable Price Trusted By 7600+ Students.

| star star star star star | 5.0 (15 ratings) |

Instructor: Agrika Khatri

Language: Mixture of Hindi & English

Enrolled Learners: 7934

Validity Period: 365 days

Over 7600 Students Are Part Of Financial Modelling Club

These Low Prices Are Valid For Limited Time & The Offer Will Expire Soon!

Businesses around the world are undergoing rapid changes.

The growing dynamics and the uncertain drivers of technology are forcing businesses to act quickly with the ever-evolving and highly uncertain demands of the market and the make-shift entities of competition which are increasingly becoming stronger by the day.

Amidst all the uncertainty, the pressure to perform for any business is higher than ever. We are living in an era that values speed and accuracy more than anything else.

Thanks to the growing uncertainty and immense pressure from all the market forces, there is a surge in new-age opportunities for all the students of Finance (especially students who are pursuing Chartered Accountancy) and students who’d like to make a mark in Big4 and Top Management Consultancies in India and abroad.

A person equipped with the knowledge of learning how to implement financial models will open doors in obtaining roles in a host of new and exciting opportunities such as Investment Banking, Management Consultancy, Financial Advisor, etc.

Having a firm grasp on Financial Models such as DCF, NPV, LBO, M&A, Relative Valuation, WACC, Project Finance etc will give your employer the required confidence to give you a challenging role in your field of preference and significantly improves your chances of climbing up the corporate ladder in any firm that you join to post your post-graduate or professional degree program.

Every year lakhs of students head out to undergo articles - An important training that is mandatory for any aspiring Chartered Accountant to finish in order to execute the completion requirements of CA under the garb of ICAI’s frameworks.

A lot of students face a severe disconnect the moment they step foot in a CA firm as they are unable to develop an interest in the traditional subjects of audit and taxation and are more inclined towards securing a job in new-age opportunities in Investment Banking, Modern Finance, and Valuation

If you have the same desire to expand your career trajectory into these new and evolving opportunities, then doing this course will help you to gain a new perspective and take you one step closer to your projected career goals.

Financial Modelling Club by Skill91 (an initiative of Edu91 by Neeraj Arora, Pooja Sharma, and Vrinda Chugh) is a course that comes with pre-recorded videos, 24x7 community discussion forum, highly detailed valuation templates, and tons of bonus features in the form of practical case studies which will keep you informed and entertained throughout your journey in this club.

This financial modelling and valuation course bundle will equip you with comprehensive knowledge in 3 powerful domains:

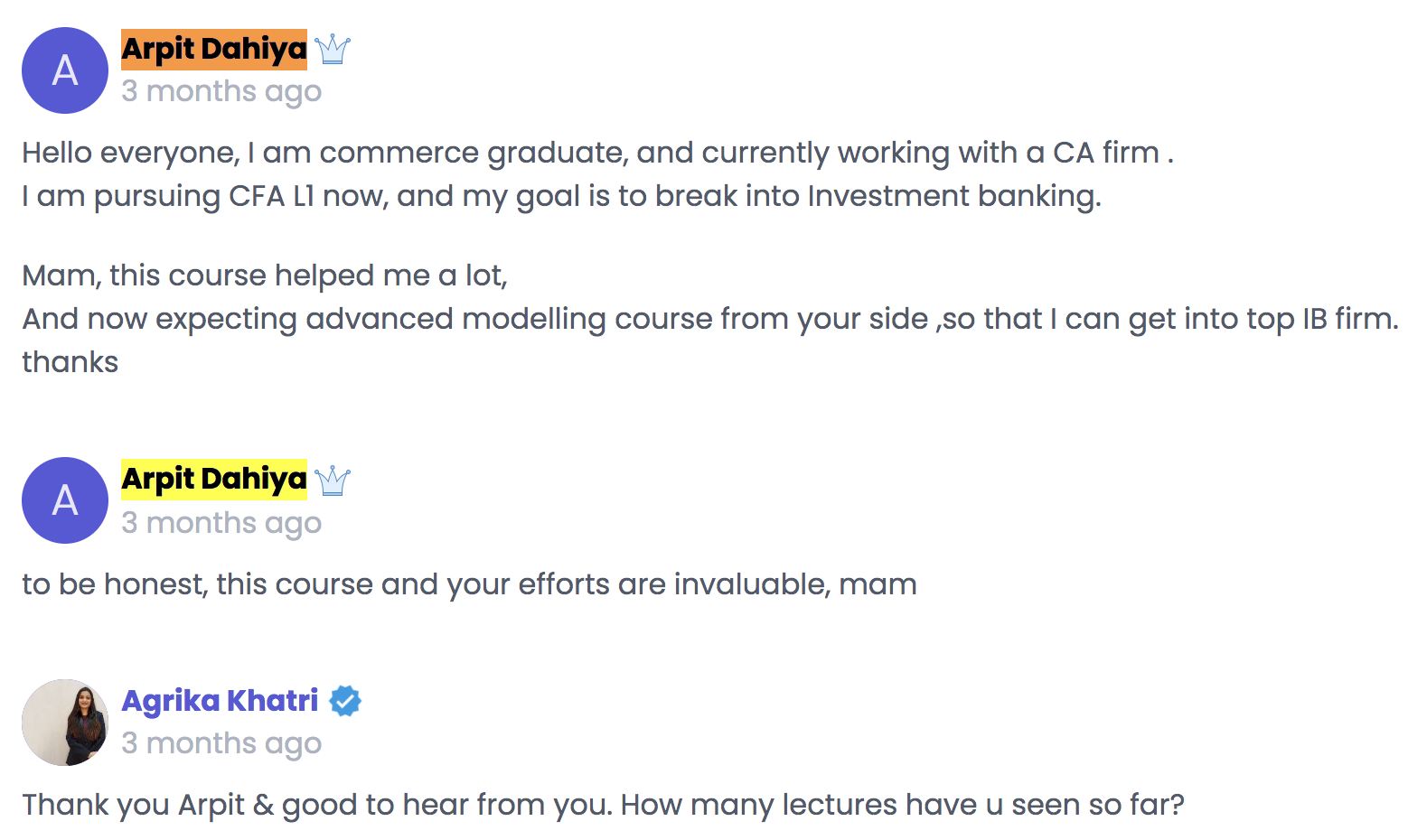

Agrika is a Qualified Chartered Account (CA) and B.Com with 5 years of diversified experience in Business Valuation, Due Diligence, Financial Modelling, & Auditing and Assurance

She has consulted and advised several companies in the transaction advisory space from all around the world

Taught 5200+ students on Valuation, Financial Modelling and other Financial Courses in India

You can also follow her on her YouTube Channel for tips, tricks, advice for CA students to excel in the field of corporate finance on “Agrika Khatri”

Why should I go for the financial modelling and valuation program?

If you have learnt concepts of accounts or finance or both sometime in your life, you must take one step forward and compress the gap between your existing theoretical knowledge and practical proficiency through this course.

Is financial modelling skill in demand?

Irrespective of your level and academic qualification, financial modelling skills have become one of the most highly sought after for finance and accounts professionals today. Good news for candidates is that there is a short supply and huge demand.

What are the career prospects after learning financial modelling?

There is a wide range of opportunities and roles available after the completion of this course. To name a few - financial analyst, financial manager, business analyst, market research analyst across domains like investment banking, sector research, equity and private equity research, credit analysis, financial planning and analysis and the list goes on.

How do I get support for any queries? How many queries can I ask?

You get access to the financial modelling discussion forum wherein you can connect with your peers and with the mentors. Doubt resolution time is usually less than 24 hours. We are giving you COMPLETE doubt support and you are free to ask your queries an UNLIMITED number of times.

I know very little to basic Excel, can I still enrol for this course?

Within the course, we have stressed enough on Excel finance functions so no need to worry. However, if you find some trouble catching up you can always clear it out on the discussion forum. Our trainers and moderators are there to help you.

Will I get a certificate?

Yes. After completing the course and mandatory test with at least 50% marks, you can apply for the certificate.